This article was released as Pharm Edaily Premium Content on November 3, 2025, at 7:17 AM.

[Seungkwon Kim, Edaily Reporter] On the 31st, the Korean pharmaceutical, biotech, and healthcare sector experienced significant movements as D&D Pharmatech Inc. hit a record high stock price following news that Novo Nordisk entered the bidding war for Metsera. Metsera‘s primary asset is an oral obesity treatment acquired through technology transfer from D&D Pharmatech. Should a major pharmaceutical company acquire Metsera, substantial milestone payments are expected in the near future. Additionally, Y-Biologics, Inc. and Geniuses also recorded sharp stock price increases.

D&D Pharmatech, Another Daily Limit Up...Novo Nordisk’s Acquisition of Partner Company Expected to Have Ripple Effects

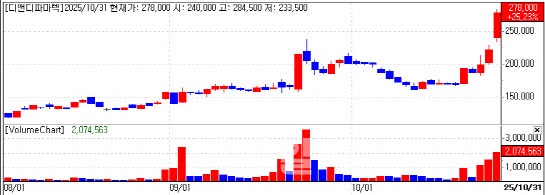

According to KG Zero In MP Doctor, D&D Pharmatech‘s stock closed at 278,000 won, up 25% from the previous trading day. Since October 27th when trading was in the 170,000-won range, the stock has risen approximately 70% over five consecutive trading sessions. Although the stock hit the daily limit and then adjusted to 25%, expert analysis suggests further upside potential remains.

The primary driver is Novo Nordisk’s proposed acquisition of Metsera. On the 30th (local time), Novo Nordisk submitted a 9 billion-dollar acquisition proposal to Metsera. This price is 2 billion dollars higher than the 7.3 billion-dollar bid Pfizer submitted in September. Novo Nordisk‘s proposal is interpreted as an aggressive move to surpass Pfizer’s existing acquisition terms.

In response, Metsera’s Board of Directors deemed Novo Nordisk‘s proposal as having “superior terms” and demanded Pfizer submit a revised bid within four business days.

As the acquisition competition between Novo Nordisk and Pfizer for Metsera intensifies, the value of Metsera’s partner company D&D Pharmatech has risen in tandem. Metsera is the company to which D&D Pharmatech transferred technology for six novel drug substances, including the oral obesity treatment candidate ‘DD02S’. In 2023 and 2024, D&D Pharmatech and Metsera concluded two technology transfer agreements totaling 803.5 million dollars (approximately 1.12 trillion won), transferring oral obesity treatment candidate substances.

Metsera‘s currently ongoing Phase 2b clinical trial for ’MET-097i‘, a GLP-1 receptor agonist that can be administered once monthly via injection, is attracting attention as a next-generation pipeline that reduces injection frequency and improves patient convenience. Additionally, the company is developing an amylin analog with superior weight loss effects and an oral obesity drug, and these pipelines have become the focus of major pharmaceutical companies.

A D&D Pharmatech spokesperson stated: “Conversations about partner company acquisitions continue to arise, but we have not conducted any internal analysis on which would be more advantageous. However, we find it encouraging that Pfizer, which previously discontinued obesity treatment development, has ultimately chosen to consider acquisition including our technology after careful review. We interpret our substance as having been recognized by a major pharmaceutical company, and view this as no different from having experience with major pharmaceutical company technology transfers.”

Y-Biologics, Geniuses Also Show Sharp Stock Price Increases...What’s the Reason

Y-Biologics‘ stock price also closed up approximately 15% at 22,850 won on this day. The stock movement is interpreted as being influenced by Celltrion’s multi-specific antibody new drug development contract. Celltrion announced that it has concluded a joint research and development contract for immuno-oncology drug innovation with Mustbio, a leading domestic multi-specific antibody development company. Through this contract, Celltrion secured joint development and global sales rights for a triple-fusion protein new drug candidate targeting PD-1, VEGF, and IL-2v.

Y-Biologics is also developing a triple-specific antibody targeting PD-1×VEGF×IL-2. The participation of a leading domestic biotech company in the multi-specific antibody development market was interpreted as favorable news. However, Mustbio‘s target is IL-2v, which is a genetically modified IL-2 protein distinct from IL-2.

Y-Biologics is closely monitoring whether Summit‘s ivonescimab will receive FDA approval. A Y-Biologics representative stated: “Our internal preclinical data has continuously demonstrated that AR170 shows better results compared to ivonescimab.

Geniuses also closed up 9.4% at 2,205 won. The stock price increase was influenced by a PharmEdaily premium article that was later released for free on portal sites including Naver, titled “”.

Park Jong-myeon, Head of R&D at Geniuses, stated: “IntelliMed is transforming the new drug development landscape” and presented specific examples. IntelliMed is an artificial intelligence precision target discovery platform developed by Geniuses.

IntelliMed replaces the traditional iterative cell and animal experiments for target discovery with data-driven analysis, thereby dramatically reducing development time and costs while improving clinical success rates, demonstrating groundbreaking innovation.

Park stated in the interview: “IntelliMed has already demonstrated clinical applicability in the cancer field,” and “Going forward, we will progressively expand application scope to include patient-specific clinical design, combination therapy exploration, and rare disease target discovery.”

댓글목록

등록된 댓글이 없습니다.