The memory sector is in a supercycle, and China is ensuring it's not left behind — and not just regarding imports from Korea. China is advancing its own semiconductor capabilities, particularly with DDR5 — the potential alternative to graphics processor units (GPUs). This effort to replace high bandwidth memory (HBM) in AI chips is reshaping the memory landscape.

Korea’s memory semiconductor exports to China totaled $7.88 billion from July to September this year — a 20 percent increase from the same period last year, amounting to nearly 2 trillion won ($1.37 billion) more, according to data from the Korea International Trade Association confirmed on Thursday.

This marks a sharp turnaround from the first half of 2025, when monthly exports had declined by 2 to 28 percent year-on-year, except for a brief rebound in April. But in August alone, exports surged by 33.2 percent. In terms of shipment volume, the increase reached approximately 60 percent.

Even compared to last year — when Chinese firms rushed to stockpile memory chips amid fears of stricter sanctions following U.S. President Donald Trump’s re-election — this year’s import volume is even higher.

Why is China soaking up DDR5?

One key reason behind the spike in Chinese demand for memory is the ongoing U.S. export controls — the Trump administration has prohibited not only U.S. companies but also allies from exporting high-end chips to China. Beijing has responded by ordering data centers with less than 30 percent completion rates to replace or cancel purchases of foreign chips.

“China, unable to use foreign GPUs, is increasing its use of AI chips made by domestic companies,” said Jeon Byeong-seo, director of research of the China Economic and Financial Research Institute. “Unable to import not only GPUs but also advanced HBM, China is replacing GPUs with DDR5 chips made in China.”

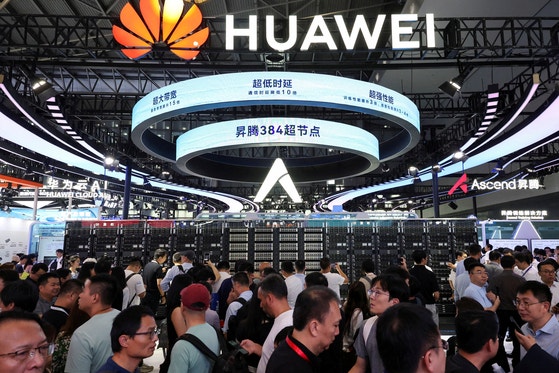

DDR5 is a high-performance Dynamic Random Access Memory (DRAM) designed to increase data processing speeds. Huawei, for example, unveiled its new Ascend 910B chip — which functions as well as Nvidia's A100 chip without HBM — at a tech conference in September, according to Jeon. Last year, Huawei announced the Ascend 910B with HBM as memory, but this time, it replaced HBM with DDR5.

China, which produced 7 nanometer — one billionth of a meter — semiconductors using deep ultraviolet equipment instead of extreme ultraviolet lithography, is once again using a "biting the bullet" mentality to overcome U.S. HBM export restrictions.

“DDR5 is needed in large quantities to replace HBM in AI chips, which is why demand for DDR5 has recently surged in China,” said Jeon. “With the AI boom driving a surge in memory demand worldwide, China's participation has further intensified the memory supercycle.”

China’s push for memory self-reliance gains speed

While China’s appetite for imports is growing, its ambitions to localize memory chip production are also accelerating. CXMT, China’s leading DRAM manufacturer, succeeded in commercializing DDR5 late last year and is now focused on improving production yield.

“The market once feared DDR5 prices would crash due to CXMT’s rapid expansion,” said a semiconductor industry insider. “That concern has eased temporarily due to rising DDR5 prices — but China’s technological progress continues behind the scenes.”

CXMT recently began sampling HBM3 to Huawei, signaling an aggressive push into the ultra-high-end memory market.

“China will increase memory output and invest more heavily in generational upgrades,” said Kwon Seok-joon, a professor of chemical engineering at Sungkyunkwan University. “Chinese firms may reach Korean-level HBM3 production capability far sooner than expected.”

According to Counterpoint Research, CXMT’s share of the global DRAM market is projected to grow from 7 percent in 2025 to 10 percent by 2027 — underscoring China's rising presence in a market long dominated by Korea's SK hynix and Samsung Electronics.

This article was originally written in Korean and translated by a bilingual reporter with the help of generative AI tools. It was then edited by a native English-speaking editor. All AI-assisted translations are reviewed and refined by our newsroom.

댓글목록

등록된 댓글이 없습니다.